На русском языке:

Это что, стабильность? Почему не тают золотовалютные резервы страны

На беларускай мове:

Гэта што, стабільнасць? Чаму не змяншаюцца золатавалютныя рэзервы краіны

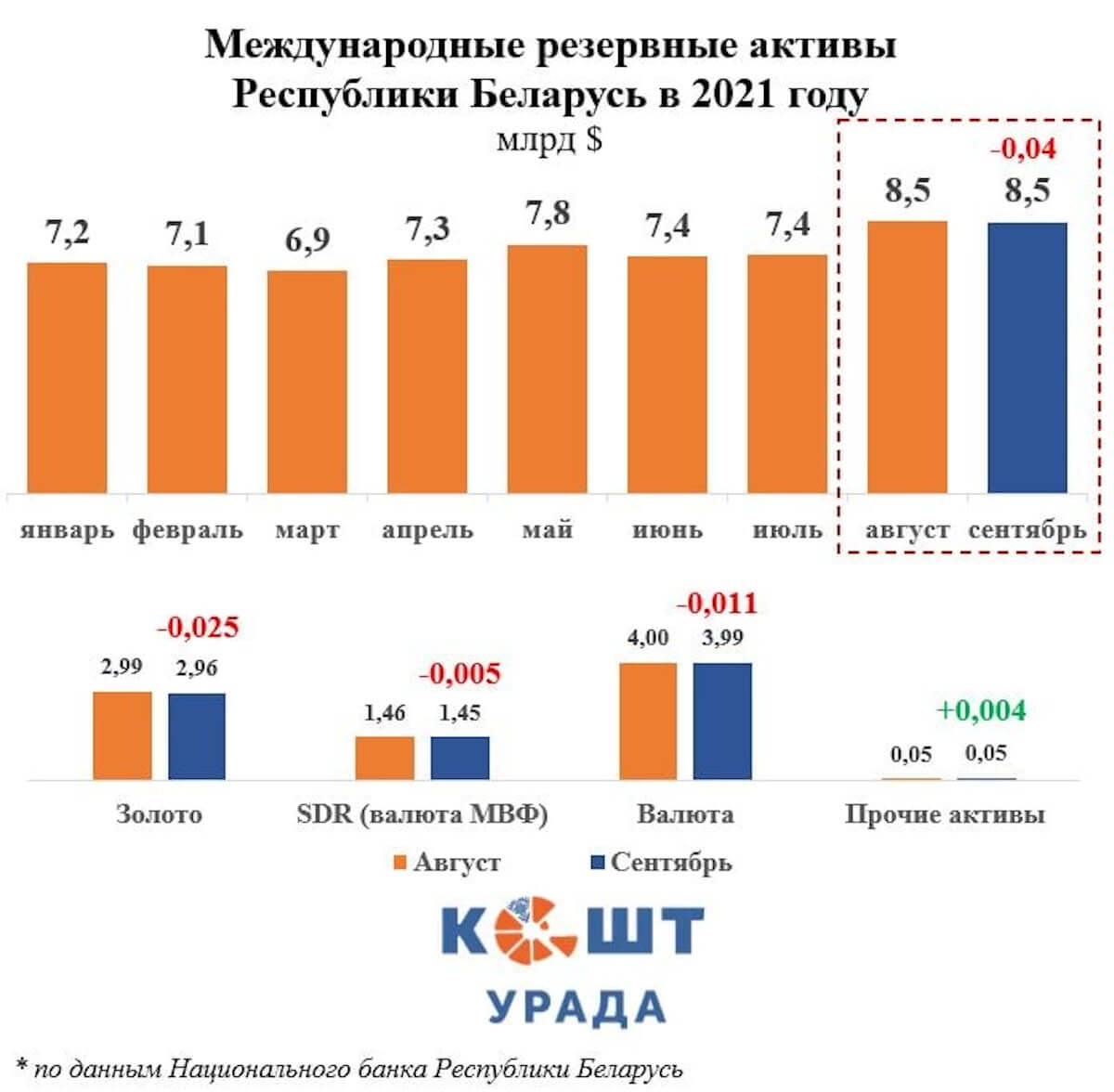

Sanctions are imposed, enterprises are becoming poorer, taxpayers are leaving the country, and for some reason, foreign exchange reserves are not melting. September data is difficult to distinguish on its number from those that were in August. Changes are calculated in tenths and hundredths of a percent. So, is it stability in the country? Not really. And the lack of changes eloquently testifies to this, the Telegram channel «Nashy Groshy» writes.

We remind that the FX reserves of Belarus can now be divided into three main components: the first is directly gold and other precious metals, the second is foreign currency and the third is the recently swollen «safety cushion», received in the form of money that the IMF allocated as assistance to mitigate the effects of the pandemic — SDR.

Why gold does not melt is clear: it was not sold or bought. The observed changes are similar to fluctuations in world prices for the precious metal.

But in a month, we managed to forget about the billion SDR inherited from the IMF. It was not sold anywhere, the debts were not repaid with it, the salary was not distributed with it. It turned out that a really beautiful figure so far is just a figure. It’s on the account, but it doesn’t seem someone to be in a hurry to use it.

SDR is quite a «complex gift», at the plant in the form of SDR salary can not be issued, even debts are not always given. This money is a convertible asset for countries that do not live under sanctions and are not persona non grata in many markets .

And what about the currency? There is as much left. Despite the fact that in September we repaid debts on external and internal obligations for $240 million. It means that there were also foreign exchange earnings in the FX reserves. And this money came, most likely, in the form of currency, which is entrusted by the population. It turns out to be a winning situation — the dollar exchange rate is kept consistently low, incomes melt, the population has to carry their savings to exchangers, this currency falls into the reserves of the state and then goes to pay debts. At the same time, this situation allows the National Bank to purchase currency at a low price. Elegantly, two birds are killed with one stone.

Only people who have ‘melting’ stash can be considered victims in this situation.

This is how the National Bank is coping with the current difficult situation: buying up cheap currency, unable to get close to the SDR and holding gold. In a word, it is hiding, and very carefully waiting for the development.