На русском языке:

«Нашы грошы» о том, почему беларусы могут усилить покупку валюты

На беларускай мове:

«Нашы грошы» пра тое, чаму беларусы могуць пачаць актыўней скупляць валюту

«Nashy Groshy» telegram channel published a post in which its authors analyze the data of the National Bank on the purchase and sale of foreign currency in the domestic market. We quote the post unchanged.

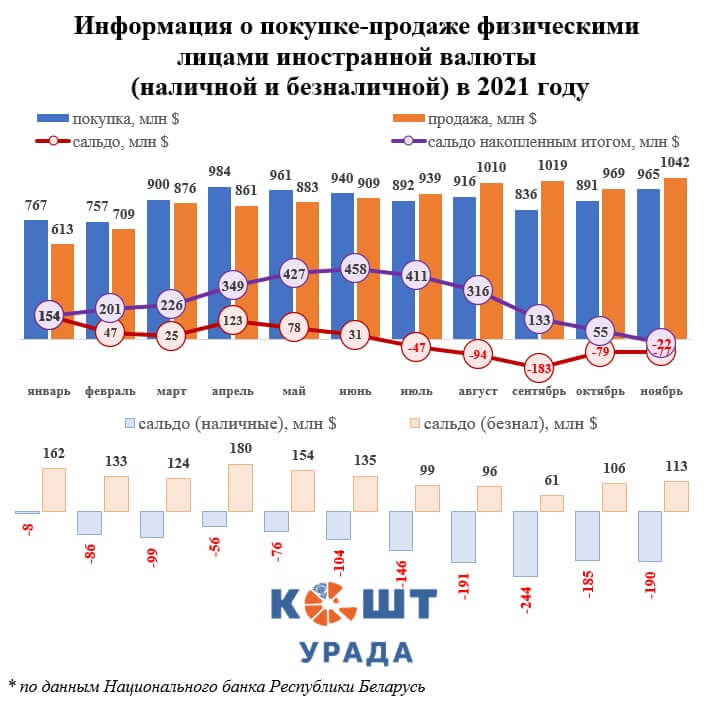

The National Bank published statistics on the purchase and sale of foreign currency in the domestic market in eleven months. It follows that the population has become a net seller of currency (that is, sells it more than buys it), and we have already written that this will happen.

What was going on?

From January to June, the population consistently bought more currency than sold. For six months, the net purchase amounted to 457.8 million dollars. Since July, the situation has changed and over the next five months, the population sold $479.6 million more than they bought.

Illustration: Nashy Groshy telegram channel

In total, in January-November, Belarusians bought $9808.4 million, and sold $9830.3 million. That is, a net purchase was formed, but it is insignificant on a national scale — $21.8 million.

Why did this happen?

It can be assumed that, seeing the difficult economic circumstances in the country and fearing that everything will become even sadder, Belarusians at the beginning of the year tried to replenish their safety cushion as much as possible. However, the resources for life were running out, and now it was time to sell the saved.

There are other factors. For example, the fact that the Belarusian ruble strengthened against other currencies this year played a role. And also — the rise in prices, which is now two times higher than the target forecast of the National Bank. This also affected the population’s need for the national currency.

This state of affairs plays into the hands of the National Bank. Due to the low exchange rate and the need of the population to buy Belarusian rubles, it can replenish foreign exchange reserves. Although, of course, this does not solve all the problems in the conditions of extremely limited access to foreign borrowed resources and a large share of debts nominated in foreign currency.

December may bring surprises, and the pendulum of statistics on the purchase and sale of foreign currency in the domestic market by the population may again swing in the other direction. Even though inflation continues to be high, the period of the cheap dollar seems to be coming to an end. The population may return to the purchase of foreign currency at the expense of pre-holiday wages against the background of growing negative expectations.