На русском языке:

«Система для обхода санкций»: Банки РБ начали подключать к СПФС еще в прошлом году

На беларускай мове:

«Сістэма для абыходу санкцый»: Беларускія банкі пачалі падключаць да СПФП яшчэ год таму

On December 9, Denis Baryshkov, a Representative of the Central Bank of the Russian Federation (CBR), said that all Belarusian banks have already been joined the Russian system for transfer of financial messages. However, the editors of motolko.help became aware that it started much earlier.

What is this system?

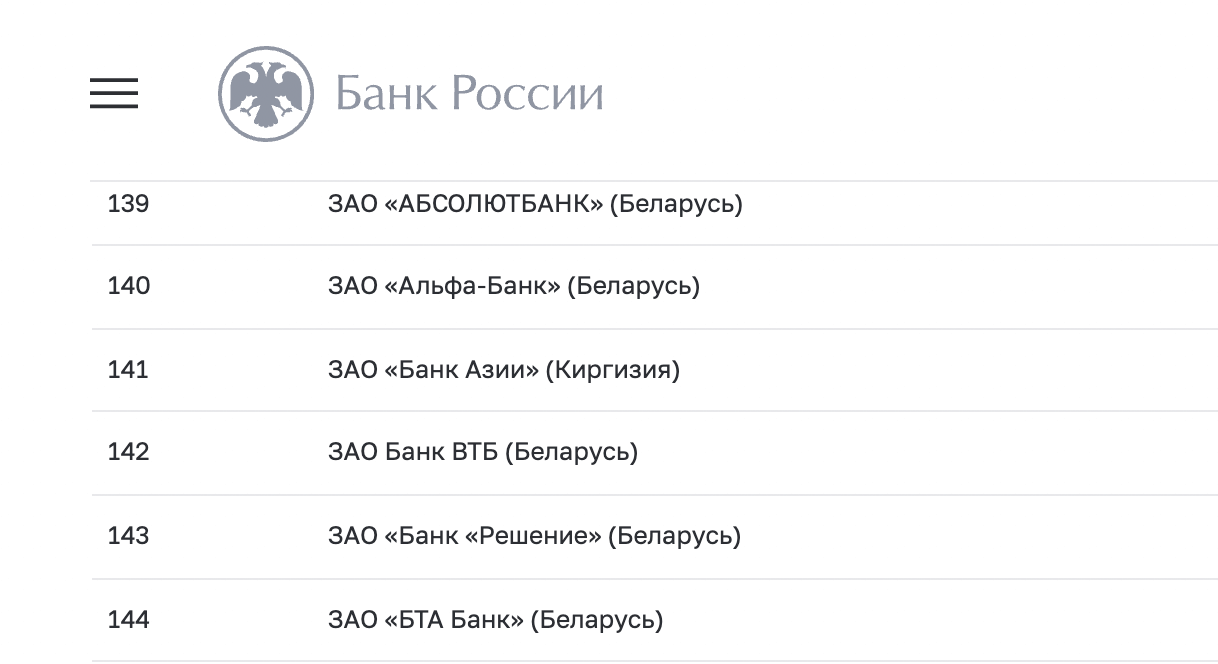

In Belarus, this system is called the «Service Bureau System for Transfer of Financial Messages» (SB SPFS). The website of the Central Bank of the Russian Federation published a list of banks joined it which contains all Belarusian banks, including the National Bank and the Development Bank. There are only two absent in the list: BSB Bank and TK Bank.

Belarusian banks joined the SPFS / cbr.ru

SB SPFS is a unified automated system of interbank settlements between the Republic of Belarus and the Russian Federation. It allows you to make interstate payments circumventing SWIFT, which in turn allows you to make payments in circumvention of EU and US sanctions.

It is also worth saying that the integration of the Belarusian and Russian systems of financial information transfer is provided for by one of 28 union programs for «deep integration». Last year, the National Bank of the Republic of Belarus, commenting on the possible disconnection of Belarus from SWIFT, noted that the integration of the Belarusian and Russian systems of SPFI (financial information transfer system) and SPFS will allow making payments between the two countries without using SWIFT.

It is worth noting that in addition to banks, the Belarusian Currency and Stock Exchange and the Belarusian Interbank Settlement Center have also joined the Russian analogue of SWIFT.

Which banks have joined the SPFS and when?

It would be natural to assume that the fact of connection to the Russian system does not mean its active use. However, we know that payments via SPFS began almost immediately after the Belarusian banks joined it. And it increases with the introduction of new sanctions by the EU and the United States. Well, yes, they also started to connect them «not yesterday», and the banks where Russian capital prevails were the first.

- March 2, 2020 — VTB Bank (Belarus), RRB-Bank and BTA Bank (Russian capital)

- June 10, 2020 — Belgazprombank (Russian capital)

- July 8, 2020 — BelWEB (Russian capital)

- September 14, 2020 — Idea Bank

- December 18, 2020 — Fransabank

- December 21, 2020 — Absolutbank, Belagroprombank

- December 22, 2020 — Tsepter Bank

- December 24, 2020 — Priorbank, BNB-Bank

- January 4, 2021 — Dabrabyt Bank

- January 11, 2021 — MTBank

- January 15, 2021 — Belinvestbank

- February 1, 2021 — Alfa-Bank

- February 10, 2021 — Paritetbank

- February 25, 2021 — Belarusbank

- April 12, 2021 — BPS-Sberbank (Russian capital)

- April 20, 2021 — Development Bank

Updated 15:40: Our readers report that the process of connecting to the SPFS has begun in 2019, but people say the system is performs badly to circumvent sanctions.

«Large banks will not want to risk their presence in Western markets, and small ones have very limited opportunities to receive funds from abroad (especially unnoticeably). Basically, this is quite a technical moment that allows you to transfer money a little faster between the Russian SBP (fast payment system, – ed. motolko.help) and Belarusian», –people write.

If you have additional information about the banking sector of the Republic of Belarus, please let us know in @motolko_bot or via the contact form below.