На русском языке:

Мнение. «Нашы грошы» про рост золотовалютных резервов в октябре

На беларускай мове:

Меркаванне. «Нашы грошы» пра рост золатавалютных рэзерваў у кастрычніку

The Telegram channel «Nashy Groshy» published a post about why the foreign exchange reserves of Belarus increased by $90 million in October. We quote this opinion unchanged.

The National Bank reported that in October the country’s foreign exchange grew by $89.8 million. It looks like positive news: they say, we are going the right way, the Belarusian ruble is getting stronger, FX reserves are growing, what else to dream about in this difficult time? But if you carefully study the reasons for this growth, and analyze the situation in which the National Bank is now, it becomes clear that in fact it has much more reasons to worry about than it may seem.

What is going on? The population continues to sell foreign currency. And the low exchange rate of the dollar and the euro, which is now maintained in the country, is beneficial to the National Bank in order to ensure a stable level of FX reserves. The state continues to buy currency on the market at an extremely favorable rate, replenishing the bins. In addition, gold prices have increased (what is in our FX reserves system has risen in price by $ 70.7 million).

So it turns out that despite the fact that the funds from the reserves were spent on the fulfillment of external and internal obligations in foreign currency in the amount of about $ 175 million, as a result, gold reserves showed growth.

Illustration: Nashy Groshy

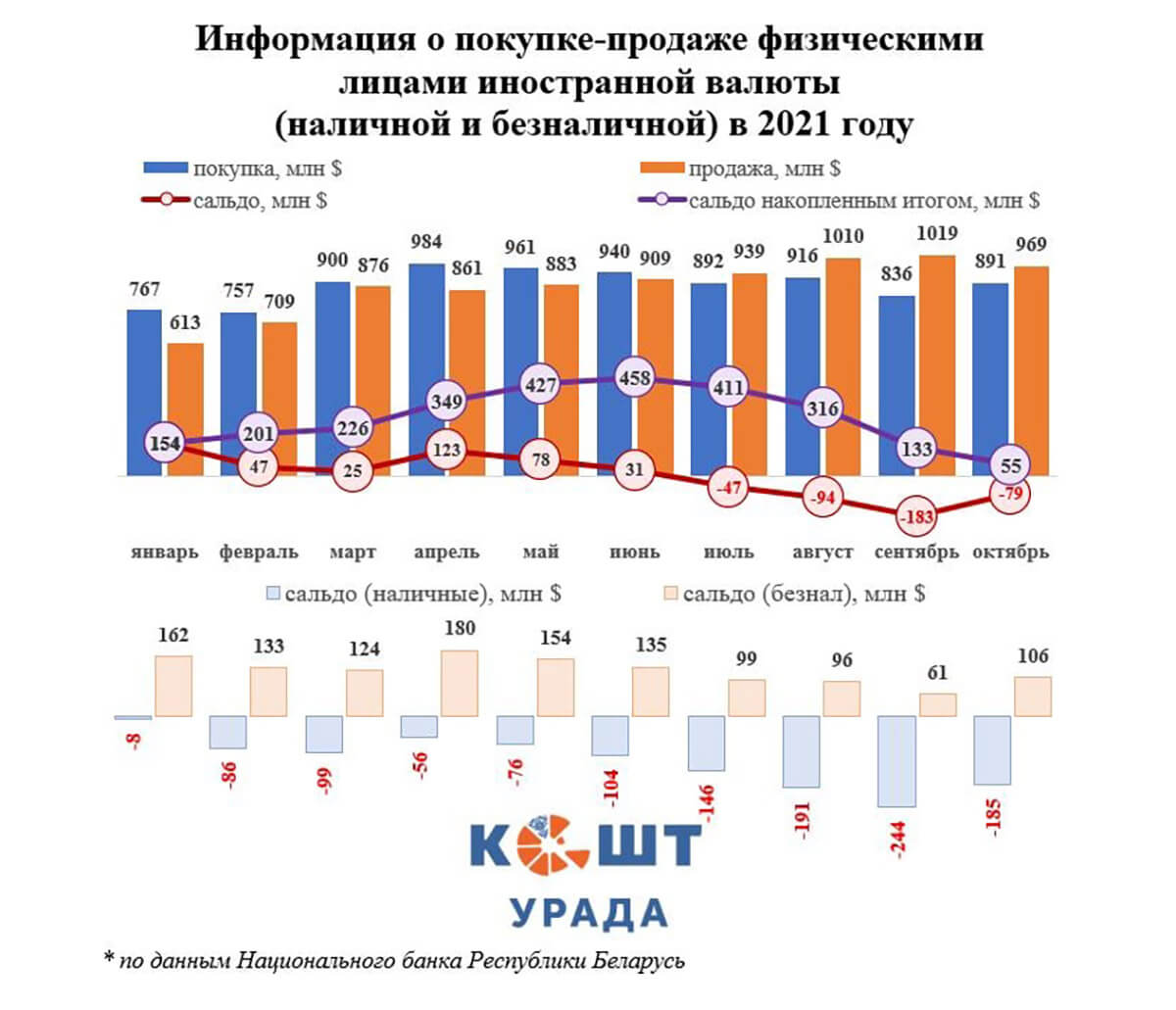

At the same time, the warning signs are already appearing, showing that in the near future the current policy may not become so effective. Remember a month ago we talked about the record billion dollars that the population sold to the state in August and September? Records ended, in October, the sale of currency amounted to $969 million, but the purchase of currency (in the aggregate cash and non-cash) increased compared to September from $863 million to $891 million.

So far, the population, according to the accumulated total of ten months, remains a net buyer of currency. The situation may change if people continue to actively surrender currency. However, in October, the net sale of currency by individuals decreased to $ 79 million after $ 183 million in September.

What does that mean? People began to turn in less currency for several reasons. First, some Belarusians have begun to deplete their stash, because wages have been falling in recent months, their purchasing power too, and prices, on the contrary, are growing significantly. The second reason is that the current dollar exchange rate seems to people less and less interesting for selling currency and more attractive for buying. Third, expectations of a (well-founded) crisis are rising, and the currency is being saved as a reliable source of savings.

What can the National Bank do in this case? He got into an ambiguous situation. The country really needs currency, and for some time, not being able to receive it in the right volumes from abroad, it was possible to «cut» it in the domestic market, buying it from people. In order for them to again carry their dollars to the exchangers, you can change the exchange rate policy — to let the rate grow, which theoretically stimulates the desire to sell the currency. However, Belarus has a special situation, and the rapidly growing dollar often motivates people, on the contrary, to buy foreign currency with the last rubles had in the wallet. In addition, the growth of the dollar will begin to accelerate inflation and will make all payments on government borrowings and loans in foreign currency more expensive in terms of Belarusian rubles. Whether the benefits of the additional currency will cover the costs of more expensive loans and borrowings is a big question.

It is likely that in the coming months we will understand what position the National Bank will choose. In any case, you will have to take some measures: you need currency to repay impressive external debts, but it is also extremely dangerous to accelerate inflation in pursuit of it.